Sample Financial Statements for Nonprofit Organizations

Wellington Zoo also shares further details for each financial statement to explain who is reporting these facts and how they comply with accepted standards. Finally, financing revenue comes from the earnings and interest earned on your financial activities and savings. We have created a sample balance sheet to help you create one for your organization.

Nonprofit vs for-profit accounting

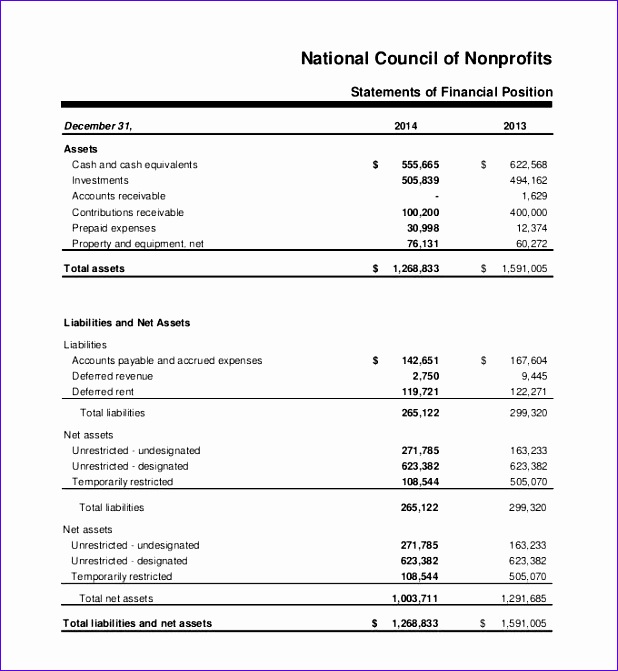

The Statement of Financial Position, also known as the balance sheet, provides an overview of an organization’s assets, liabilities, and net assets at a specific point in time. It shows the organization’s financial position and helps assess capital budgeting: what it is and how it works its liquidity and solvency. It’s important to note that nonprofit financial statements are not just for internal use. They are also used for compliance purposes, as regulatory bodies require nonprofits to submit these statements regularly.

Assessing Financial Health of a Nonprofit

The Statement of Activities summarizes the money you’ve received (revenues) and the money you’ve spent (expenses) during a given period. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. If you use a checkbook framework to understand accounting, you are only working out the Net Assets bucket.

Understanding the Net Assets Section

Or create reports at the department level to make sure each team member gets all the information they need (and only the information they need). When a board member asks for a cash flow statement, usually it’s because you’re losing cash. It is completely ok and acceptable to have multiple versions of your financial reports.

What is nonprofit accounting?

- Cash basis accounting is simpler and easier to understand compared to accrual basis accounting, which is commonly used in for-profit organizations.

- It gives insight into the organization’s financial performance and whether it is generating enough revenue to cover its expenses.

- Non-Current liabilities are liabilities that will not become due within the next year.

- The current ratio measures assets that will be cash within a year and liabilities that will have to be paid within a year and can provide an indication of an organization’s future cash flow.

- It allows stakeholders, including donors, grantors, board members, and management, to assess the organization’s financial health and sustainability.

- The inclusion of the text and photographs in Wellington Zoo’s annual report further encourages trust in the organization.

When listing your nonprofit’s liabilities, you must list them by when they must be paid and separated by current and long-term liabilities. It’s best to hire an in-staff or freelance accountant to create these reports, but if funds are unavailable, we hope this article helps you get started. Check out other articles we’ve provided on nonprofit accounting and accounting software. Your nonprofit must also include your balance sheet with a snapshot of your organization’s finances at the beginning and end of the year when filing annual taxes with Form 990. Many nonprofits have small staffs and tight budgets, making it difficult to dedicate personnel to bookkeeping and financial reporting tasks.

Changes in Net Assets

Additionally, you’ll need financial statements to obtain and maintain funding, grants, and other forms of support. Accurate financial statements also ensure nonprofits manage charitable resources responsibly, ethically, and according to applicable laws. This guide will cover all the essentials of nonprofit accounting, from setting up your books to preparing financial statements. With this knowledge, you’ll be able to make data-driven decisions and manage your nonprofit’s finances with confidence. All nonprofits with gross receipts above $50,000 are required to file an IRS Form 990.

Nobody wants to dig through the proverbial “shoebox” of receipts come reporting time. After you’ve registered as a nonprofit with your state, the next step is to apply for tax-exempt status under Section 501. Take our 2-minute survey to find out if outsourced accounting and bookkeeping is a good fit for your organization.

Code for Science & Society depicts their financial expenses on this page of their report rather concisely and transparently. Online websites like Charity Navigator and GuideStar also use these reports to rate your organization. Here’s an example from Code for Science & Society’s Statement of Financial Position from 2021. You’ll also have to present your expenses in a specific way that may differ from how you present them for your audit. The report displays the budget and the actual numbers side-by-side so you can easily see where you’re beating your plan or coming up short. But it won’t show you what happened to the cash you spent, which is generally what board members want to know.

This is because those assets are tied up in physical belongings (property, software, etc.) and cannot be liquidated to cover additional liabilities. Then, divide this number by the average monthly expenses incurred by your organization. The result is the number of months that you can cover with the liquid assets you have on hand. The assets section of your nonprofit balance sheet defines what your nonprofit owns. It includes items like your cash assets, accounts receivable, property and equipment investments, long-term receivables, prepaid expenses, and more.

Typical categories include program services, management and general, fundraising, and other sources of income. You can use the statement to assess the usage of funds, track performance, and make decisions about future operations. You may also need to provide other information, like unrealized gains or losses on investments and noncash transactions, such as depreciation or amortization expenses. As with any financial statement, ensure that all figures are accurate and up to date before submission. It also outlines the reporting, filing, and notification requirements related to a nonprofit’s activities.

The operating activities section of the Statement of Cash Flows provides valuable insights into the day-to-day financial operations of a nonprofit organization. It outlines the cash inflows and outflows that are directly related to the organization’s core activities. In the Operating Activities section, the statement shows the cash flow from the organization’s ongoing, regular business activities.