Payback Period: Definition, Formula, and Calculation

Theoretically, longer cash sits in the investment, the less it is worth. In order to account for the time value of money, the discounted payback period must be used to discount the cash inflows of the project at the proper interest rate. The period of time that a project or investment takes for the present value of future cash flows to equal the initial cost provides an indication of when the project or investment will break even.

When Would a Company Use the Payback Period for Capital Budgeting?

The time value of money is the idea that cash will be worth more in the future than it is worth today, due to the amount of interest that it can generate. This is another reason that a shorter payback period makes for a more attractive investment. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment outlay, as measured in after-tax cash flows.

Payback Period (Payback Method)

In addition, the potential returns and estimated payback time of alternative projects the company could pursue instead can also be an influential determinant in the decision (i.e. opportunity costs). The breakeven point is the price or value that an investment or project must rise to cover the initial costs or outlay. The payback period refers to how long it takes to reach that breakeven. One of the most important concepts every corporate financial analyst must learn is how to value different investments or operational projects to determine the most profitable project or investment to undertake. One way corporate financial analysts do this is with the payback period. For example, if solar panels cost $5,000 to install and the savings are $100 each month, it would take 4.2 years to reach the payback period.

How to Export Revit Schedule to Excel

Once you have calculated the payback period, it’s essential to interpret the results correctly. If your payback period is shorter than your expected useful life (i.e., the time until the project becomes obsolete), the investment can be deemed profitable. Let us see an example of how to calculate the payback period equation when cash flows are uniform over using the full life of the asset. Obviously, the longer it takes an investment to recoup its original cost, the more risky the investment.

Payback Period: Definition, Formula, and Calculation

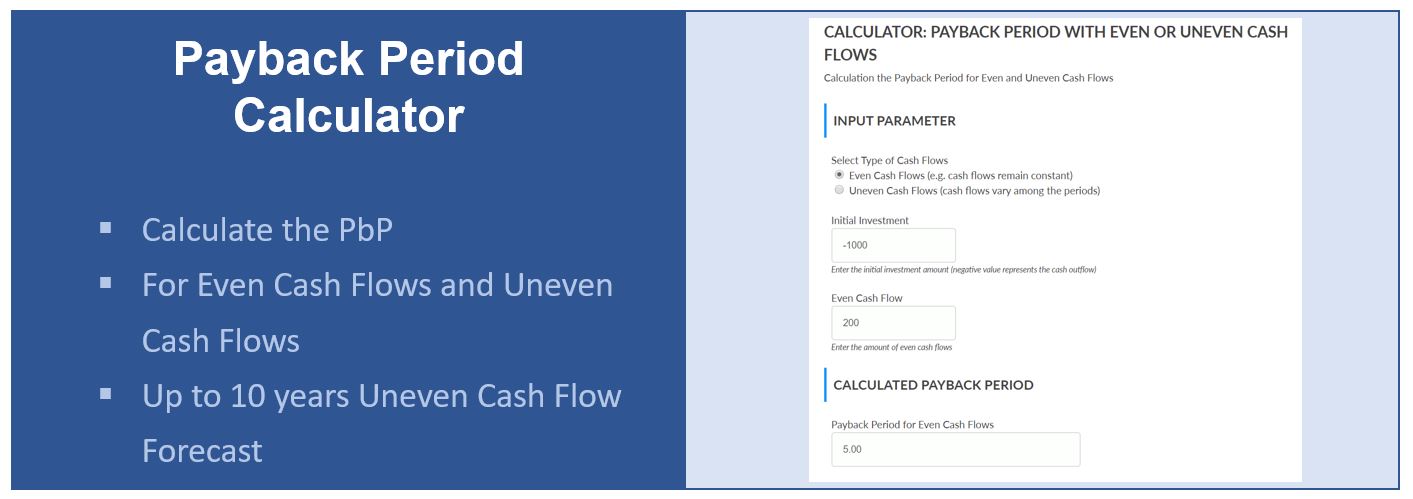

• Downsides of using the payback period include that it does take into account the time value of money or other ways an investment might bring value. Assume Company A invests $1 million in a project that is expected to save the company $250,000 each year. If we divide $1 million by $250,000, we arrive at a payback period of four years for this investment. Others like to use it as an additional point of reference in a capital budgeting decision framework. If you are interested in the financial aspect, then the payback period is an important number for your decision-making.

- Calculating payback periods is especially important for startup companies with limited capital that want to be sure they can recoup their money without going out of business.

- A large purchase like a machine would be a capital expense, the cost of which is allocated for in a company’s accounting over many years.

- Others like to use it as an additional point of reference in a capital budgeting decision framework.

- Let’s say Jimmy does buy the machine for $720,000 with net cash flow expected at $120,000 per year.

Management will set an acceptable payback period for individual investments based on whether the management is risk averse or risk taking. This target may be different for different projects because higher risk corresponds with higher return thus longer payback period being acceptable for profitable projects. For lower return projects, management will only accept the project if the risk is low which means payback period must be short. When deciding whether to invest in a project or when comparing projects having different returns, a decision based on payback period is relatively complex. The decision whether to accept or reject a project based on its payback period depends upon the risk appetite of the management.

If the discounted payback period for a certain asset is less than the useful life of that asset, the investment may be approved. If a business is choosing between several potential investments, the one with the shortest discounted payback period will be the most profitable. These two calculations, although similar, may not return the same result due to the discounting of cash flows. For example, projects with higher cash flows toward the end of a project’s life will experience greater discounting due to compound interest. For this reason, the payback period may return a positive figure, while the discounted payback period returns a negative figure.

In this case, the payback period shall be the corresponding period when cumulative cash flows are equal to the initial cash outlay. The discounted payback period is often used to better account for some of the shortcomings, such as using the present value of future cash flows. For this reason, the simple payback period may be favorable, while the discounted payback period might indicate an unfavorable investment. The discounted payback period is a simple metric to determine if an investment will be sufficiently profitable to justify the initial cost. It uses the predicted returns from the investment, but also takes into consideration the diminishing value of future returns. The basic method of the discounted payback period is taking the future estimated cash flows of a project and discounting them to the present value.

Financial modeling best practices require calculations to be transparent and easily auditable. The trouble with piling all of the calculations into a formula is that you can’t easily see what numbers go where or what numbers are user inputs or hard-coded. The sooner the break-even point is met, the more likely additional profits are to follow (or at the very least, the risk of payback period formula losing capital on the project is significantly reduced). Each company will internally have its own set of standards for the timing criteria related to accepting (or declining) a project, but the industry that the company operates within also plays a critical role. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.